Hollywood's New Frontier: Unionization and Local Giants Reshape the US Micro-Drama Market

The landscape of short-form vertical video in the United States is rapidly maturing, moving beyond a simple content rush to a complex, regulated, and professionalized industry. Key actions taken by major US guilds and the entry of well-resourced local players in October have initiated a decisive "upgrade battle," forcing Chinese outbound content producers to re-evaluate their strategies for the market that contributes nearly half of global overseas micro-drama revenue.

The New Labor Reality: Guilds Raise the Barrier to Entry

In October, a watershed moment occurred when the two most powerful industry unions, the Screen Actors Guild – American Federation of Television and Radio Artists (SAG-AFTRA) and the Writers Guild of America (WGA), established new protective frameworks for the micro-drama sector.

● SAG-AFTRA's Verticals Agreement: Specifically designed for vertical micro-dramas with budgets under $300,000, this agreement aims to guarantee fundamental rights and protections for actors.

● WGA's Minimum Basic Agreement (MBA): The WGA affirmed that screenwriting for micro-dramas falls under the MBA, securing core rights like minimum pay, screen credit, and benefits for writers.

These guild movements fundamentally alter the talent pool available to international producers:

1. Talent Migration: Actors and writers previously operating outside of the union framework will be incentivized to join, seeking the structured rights and benefits the guilds provide.

2. Professionalization: Highly skilled, established union members, who may have previously disregarded the format, may now consider entering the micro-drama space, knowing their core terms are protected.

For Chinese teams currently operating outside the union structure, accessing this high-quality, unionized talent will become significantly more difficult and expensive. To utilize union talent, an international producer must become a US-registered entity, undergo a lengthy application process, sign the necessary agreements with SAG-AFTRA, and adhere strictly to all union regulations regarding compensation, residuals, and working conditions. This translates directly to higher production and management costs.

Teams that choose to forgo union compliance will be relegated to hiring less experienced newcomers, placing an increased burden on them to train talent and manage quality—a unsustainable model as the competition heats up.

Hollywood's Counterattack: Local Giants Mobilize

Simultaneously with the guild movements, established US media powers began their strategic entry into the micro-drama market, aiming to leverage their professional infrastructure:

● Platform Launch: In October, Alan Mruvka, founder of E! Entertainment Television (part of NBCUniversal), prepared to launch Verza TV, positioning it as the first US-based micro-drama platform built from the ground up.

● Studio Formation: MicroCo, touted as a premium micro-drama studio with intricate ties to Hollywood capital, was established, signaling an intent to produce high-quality, professional content domestically.

These local entrants are poised to achieve "professionalization + industrialization." While their per-episode costs may be higher than those of fast-producing Chinese firms, their access to top-tier local writers and actors (facilitated by the union agreements) will result in content with deeper cultural resonance and superior production quality. Once the economy of scale is achieved under this model, Chinese companies relying primarily on speed, volume, and low margins will find their competitive advantage rapidly eroding.

Strategic Pathways for Chinese Outbound Players

The escalating competition necessitates a strategic shift away from simple "Channel Expansion" (dumping translated content) toward "Capability Export" (integrating into the local ecosystem).

1. Deep Localization and Talent Integration

The superficial localization of the past—focused only on translating slang—is no longer enough. Successful integration requires a new level of commitment:

● Establish Local Creative Hubs: Directly investing in and establishing local writing and production bases within the US is vital. This is the only way to genuinely capture the cultural pulse and address sensitive local social issues effectively.

● Strategic Collaboration: Actively seeking collaboration with local teams who are experienced in navigating the complex WGA and SAG-AFTRA regulations.

● Data + Culture Synergy: Combining the Chinese players’ advanced data algorithms—used for identifying trending narratives and optimizing content release—with the cultural and narrative insight of local creative teams to discover untapped content niches.

2. Differentiated Content Strategy

Instead of engaging in a costly direct battle with Hollywood over mainstream themes, Chinese companies should focus on creating distinct content:

● Niche Genre Exploration: The rich IP vault of Chinese online literature offers unique, differentiated genres that are largely absent from the current US market. Themes like Chinese fantasy (玄幻, xuanhuan), palace intrigue (宫斗, gongdou), wuxia/xianxia, and qigong-flow cultivation could attract specific, dedicated sub-audiences and establish a recognizable market niche.

3. Capital-Driven Market Access

The most efficient route to compliance and professional talent is often through financial investment:

● Acquisition or Investment: Pursuing direct investment in, or acquisition of, existing US local production companies that are already union-compliant. This strategy effectively "exchanges capital for time," immediately granting access to professional infrastructure and talent without the lengthy setup process.

Conclusion: Preparing for the Upgrade Battle

The US micro-drama market has irrevocably changed. The new competitive landscape demands a focus on content quality, cultural depth, and robust vertical integration.

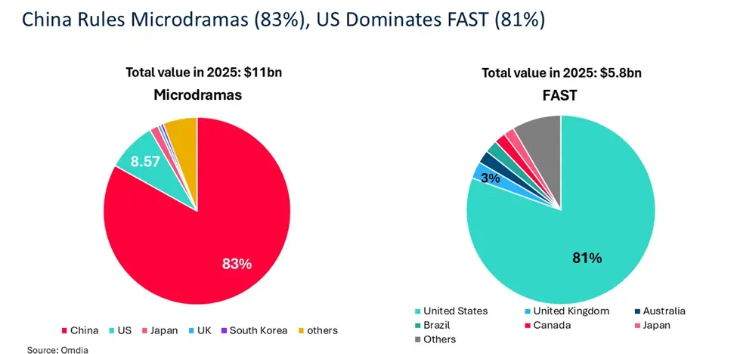

Furthermore, the global outlook confirms the growth trend, with Omdia predicting micro-dramas will generate $11 billion in global revenue by 2025, nearly doubling the projected revenue of FAST channels.

For Chinese outbound players, the future involves not just navigating US guild pressure but also contending with burgeoning global competitors. Only by fundamentally re-adjusting strategies, investing in deep localization, and strategically leveraging their unique advantages can they truly establish deep roots and lead in this next phase of global content competition.

This is a newly generated, original, and informative English article based on the background information you provided, specifically targeting an overseas business or media audience.

![[Dubbed Version]Shared Sensations, Bound Destinies](https://v.melolo.com/b1265344voduse1318177724/0cf6349a5145403705095313428/GWjBiJkGTlQA.webp!15491.webp!15491.webp)

![[Dubbed] My Heartless Wife](https://v.melolo.com/b1265344voduse1318177724/f1bb73b31397757912474287434/pNWywlIukLsA.jpg!15491.webp!15491.webp)

![[Dubbed Version] In Our Youth](https://v.melolo.com/b1265344voduse1318177724/13e6849c5145403706118740249/h7meXFL7KWAA.webp!15491.webp!15491.webp)