Southeast Asia's Micro-Drama Gold Rush: Navigating Compliance and Young Consumers in a $2.3 Billion Market

While the North American micro-drama market grapples with escalating costs and high-stakes in-app purchase (IAP) battles, a dynamic and less saturated frontier—Southeast Asia (SEA)—is emerging as the new growth engine for global content producers.

With a massive population of over 600 million, an average age below 30, and mobile internet penetration exceeding 80%, SEA presents characteristics often compared to a "second Chinese market" due to its scale and high engagement. However, success in this "blue ocean" requires more than just scaling content; it demands mastery of deep cultural diversity, complex regulatory frameworks, and challenging monetization models.

This article examines the unique content logic, market structure, and future strategies necessary to capitalize on Southeast Asia's fragmented consumption boom.

The Cultural and Regulatory Quagmire

Southeast Asia’s foundation as a content market is built on its unparalleled cultural compatibility. Over 300 ethnic groups coexist, fostering a tolerance that embraces Chinese dramas like Love Between Fairy and Devil, alongside Japanese, Korean, and Hollywood works.

Crucially, historical overseas Chinese communities have created a deep resonance for core Chinese narrative themes, such as "rags-to-riches" stories and "family responsibility." This cultural alignment is the reason dubbed or translated Chinese dramas currently capture 80% to 90% of the market share.

Yet, this cultural tapestry is intertwined with a complex and disparate regulatory landscape:

| Country | Key Legislation | Core Compliance Challenge |

| Indonesia | Electronic Information and Transaction Law (ITE Law), Film Law | Strict defamation and threat penalties; mandatory content age classification (four tiers, up to 21+). |

| Philippines | Creative Industry Act | Highly supportive, offering infrastructure and fiscal incentives for audiovisual media production. |

| Thailand | Computer Crimes Act | Prohibits harmful content; extreme caution needed around portrayal of the Royal Family, which can be deemed a national security offense. |

Electronic Information and Transaction Law (ITE Law), Film Law

[Image from International Center for Not-for-Profit Law (ICNL)]

The necessity for market-by-market compliance means a one-size-fits-all strategy is unfeasible. Foreign producers must invest in localized legal and cultural vetting to avoid policy pitfalls.

High Growth, Low ARPU: The Market Paradox

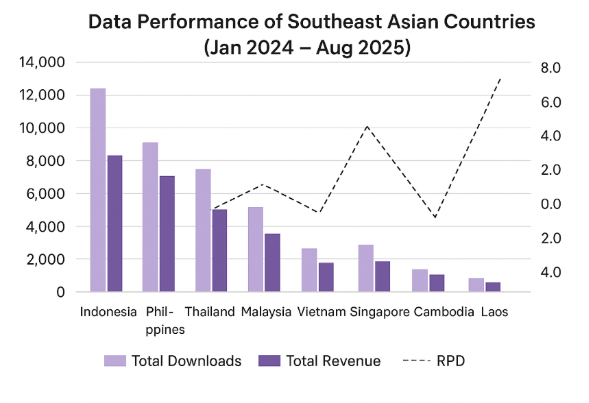

From January 2024 to August 2025, the SEA micro-drama market generated close to $233 million in revenue and accumulated over 260 million downloads, confirming its potential as a global growth driver.

However, the market exhibits a structural paradox characterized by "high growth, low monetization."

Market Bipolarity by Country (Jan 2024–Aug 2025):

● Indonesia is the core volume driver, accounting for 58% of all downloads. However, strict content laws increase compliance costs, and monetization remains a challenge.

【resource: Appfigures】

● Thailand shows a stronger willingness to pay for quality content, making it a higher-value market despite lower download volumes.

● Vietnam and the Philippines have very young user bases that readily adopt fast-paced content, but generally display low paid conversion rates.

The competitive landscape is currently divided:

1. Chinese Outbound Enterprises: Dominant players like Dramabox (Dianzhong) and ShortMax (Jiuzhou Culture) leverage mature industrial systems, enabling streamlined processes (e.g., 45 days from script to overseas launch) and high volume (50+ new dramas monthly per platform).

2. Internet Giants: ByteDance is testing the waters with the completely free, ad-free Melolo app, while Tencent and iQIYI integrate micro-drama modules into their long-form video platforms.

3. Local Enterprises: Platforms like Singapore’s Viddsee and Indonesia’s Klik Film build cultural barriers by integrating traditional arts (e.g., Malaysian shadow puppetry, Thai Khon drama) and collaborating with Chinese studios to develop bespoke, locally-nuanced content.

Despite surging downloads, the region's monetization efficiency is low. The first half of 2025 saw SEA contribute just over 10% of global micro-drama in-app purchase revenue, with Average Revenue Per User (ARPU) only about one-quarter of the North American market.

This "high volume, low conversion" scenario has cemented Advertising Monetization (IAA) as the dominant business model, a sharp contrast to the IAP-driven model in the West. Leading platforms are now using a "translated content + advertising" hybrid model to convert a high daily active time (8–10 hours per user) into ad revenue, which now accounts for up to 20% of total revenue.

The Content Code: Young Women and Fragmented Consumption

The key to unlocking the SEA market is understanding its core consumer: young women aged 18–40, with the 25–34 age group being the largest segment at 37.89%. Platforms like DramaWave have reported female audiences making up over 84% of their ad reach, driving the popularity of tropes like "marriage by proxy" and "dominant CEO".

Consumption is highly fragmented, clustering around three main peaks:

● Commuting Hours (45% of morning/evening traffic)

● Lunch Breaks

● Bedtime (21:00–23:00 being the nightly peak)

Content preference varies by age: younger users (18–24) favor fantasy and campus themes, while older groups (25–34) focus on workplace and romance, and the 35–40 demographic prefers family ethics and comedy.

Given the low overall willingness to pay, users primarily unlock episodes by watching advertisements. While Malaysia has the highest Revenue Per Download (RPD) in the region at $1.53 in 2024, this figure is still significantly lower than Western benchmarks.

Production Divide: Translated vs. Local

| Content Type | Production Cycle | Cost Efficiency | Role in Market |

| Translated Dramas | 10 days (Fastest) | High (Subtitle translation: ~40 RMB/min; 100 episodes dubbing: ~6,500 RMB) | Market foundation; relies on cultural affinity and speed. |

| Local Dramas | 5–7 weeks | Lower (~$50,000 USD for an 80-min series) | Higher cultural fit; aims for deeper emotional resonance and market integration. |

The introduction of AI technology, exemplified by platforms like All Voice Lab, has accelerated efficiency, enabling the translation of 1,000 minutes of content in just 12 hours and reducing manual costs by over 15 times. However, for true market penetration, investing in more costly local productions remains essential.

Future Outlook: Strategies for Long-Term Dominance

Despite the clear potential, several challenges loom for players in the SEA micro-drama space:

● Operational and Communication Hurdles: A lack of professional local filming crews necessitates mobilizing personnel from home, increasing cross-regional costs. Language barriers (many local teams do not operate in English) and unfamiliarity with micro-drama production logistics slow down professional exchange.

● Cultural and Compliance Risk: The 11 nations’ diverse policies require careful navigation around sensitive issues like religion, gender, and royalty. E.g., Indonesian actors may resist intimate scenes in romance dramas; Thai content requires delicate handling of Buddhist elements.

● Monetization and Content Saturation: Low local participation leads to a concentration of themes (dominant CEO, revenge), resulting in fierce competition. The core pain point remains the "high traffic, low conversion" characteristic, with RPD often below $0.30 in key markets.

However, these challenges present clear opportunities for strategic differentiation:

● Untapped Content Niches: Beyond the saturation of "dominant CEO" and "revenge" narratives, significant demand exists for mystery, fantasy, silver-haired (elderly) themes, local IP adaptations, and holiday-specific content.

● Leveraging AI for Efficiency: Continued AI integration, from multi-language translation to script assistance, will further reduce production costs and shorten cycle times, creating a clear cost advantage.

● Developing Derivative Markets: Following trends seen with Netflix (gamification of IP) and YouTube (e-commerce integration with "shop the look"), SEA micro-drama platforms must develop secondary revenue streams. Untapped areas include character merchandise, brand collaborations, and fan economy models, which can significantly boost ARPU for top-tier IP.

The future of the SEA micro-drama market will be defined by the dual ability to achieve deep localization and monetization innovation. Establishing end-to-end local production systems, building differentiated monetization strategies, enhancing data-driven operational capabilities, and refining risk control mechanisms are the essential components for long-term competitive advantage.

Platforms that successfully blend cultural fluency with commercial efficiency are poised to lead the next phase of high-quality growth in Southeast Asia’s dynamic content ecosystem.