AI Micro-Dramas Go Global: Millions in Funding, Hundreds in Production, and a Southeast Asian Pilot

The "AI micro-drama arms race" overseas appears to have quietly begun.

Recently, several pieces of news have been making waves:

● Fox Entertainment invested in Ukrainian AI micro-drama company Holy Water, promising to create 200 short dramas for My Drama.

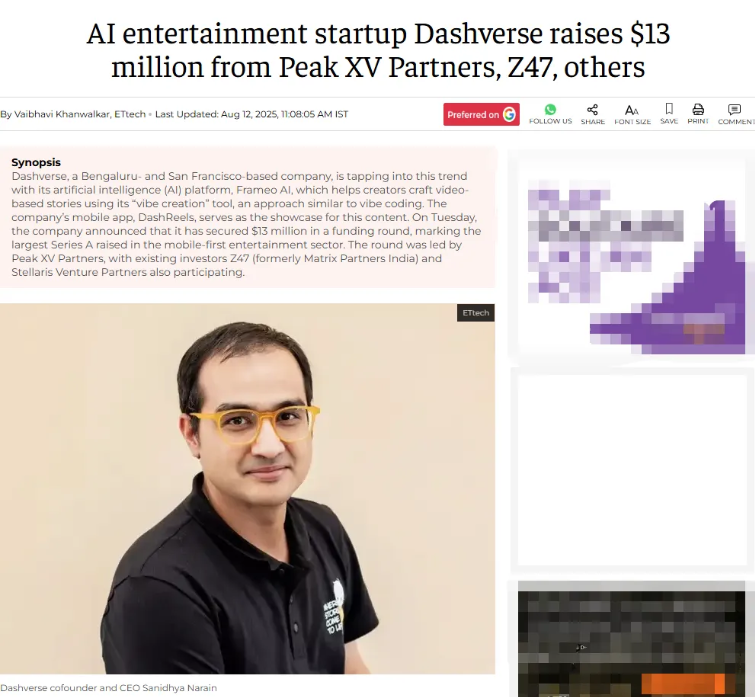

● India's Dashverse successfully secured $13 million in funding for its AI micro-drama business, issuing a mandate to produce 100 episodes before the end of the year.

● Leading global platforms DramaWave and FlareFlow have also launched AI micro-drama content.

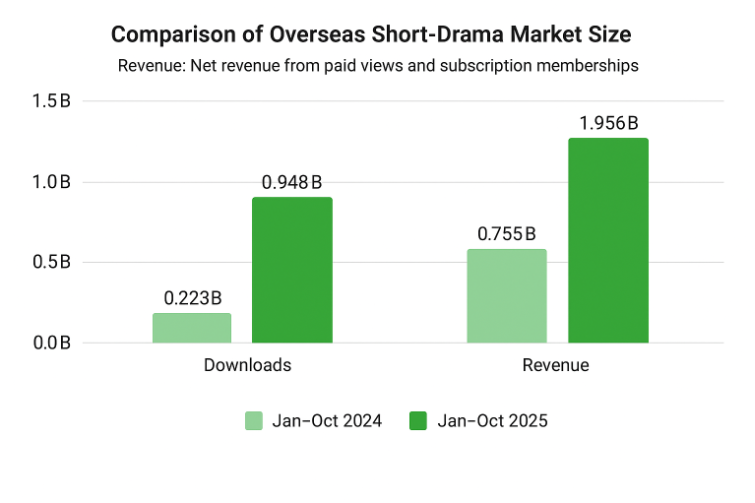

Capital and platforms are moving forward in tandem, backed by a rapidly growing market: as of October 2025, overseas micro-drama revenue and downloads have surged by 159% and 325% year-on-year, respectively, with the market size approaching $2 billion.

[Resource: Appfigures]

However, the backbone of this prosperity remains "dubbed dramas," which account for up to 90% of the content. The industry consensus is that the production capacity for truly localized dramas, which can genuinely penetrate overseas markets, is nowhere near the demand.

When the market craves new stories, and traditional live-action filming is mired in high costs, AI is unanimously regarded by global players as the "ultimate answer" for reducing costs and increasing efficiency.

Questions naturally follow: Who are the key players in the overseas AI micro-drama space? How far has it developed? Can it truly become mainstream? And how much of a share can China's AI micro-dramas grab from this global push?

Note: The "AI micro-drama" discussed in this article refers to short dramas generated by AI, including AI animated comic dramas.

India: Millions in Funding, Millions of Views, Hundreds in Production

India has shown the most aggressive moves in the overseas AI micro-drama space.

While Holy Water secured its partnership with Fox Entertainment, taking its first step on the AI micro-drama journey, India's Dashverse has likely almost spent its first major capital injection across the ocean.

On August 12, Indian local micro-drama company Dashverse completed its Series A funding round, raising $13 million. The funds are primarily earmarked for the research and development of the AI creation tool Frameo.AI and incentives for AI content creators. With both product and capital in place, the AI micro-drama is set for robust growth.

Co-founder Narain stated clearly: "We will invest 60-70% of the raised capital into the R&D of Frameo.AI to build a high-quality AI platform specifically for micro-drama production."

Three days after securing the funding, Raftaar, dubbed "India's first AI-generated micro-drama," premiered on Dashverse's micro-drama platform DashReels.

Within 15 days of its launch, it garnered over 1 million views, with a completion rate exceeding 75%, which is 90% higher than the completion rate of other micro-dramas on the same app.

Immediately afterward, Dashverse announced its plan to "launch 100 AI micro-dramas before the end of 2025." [Screenshot from DashReels]

[Screenshot from DashReels]

In fact, the first seed of AI micro-dramas was sown in Indian mythological themes as early as July.

Mahabharata: A War for Justice, hailed as "India's first mythological AI micro-drama," was widely acclaimed upon release. Based on the ancient Indian epic of the same name, the series was developed by Historyverse, a micro-drama platform under the Indian digital content company Collective Media Network. The first season comprises 100 episodes, each lasting 3-4 minutes. [Image from related report]

[Image from related report]

By the end of October, the series further expanded its reach through partnerships with Indian streaming platform Jio Hotstar, Indian TV channel Star Plus, and Snapchat.

Its premiere on Jio Hotstar achieved the astonishing result of over 6.5 million views, 2.1 times the average viewership, and broke the platform's premiere viewership record.

Perhaps riding on the success of this hit, Historyverse's epic micro-drama section on Snapchat has already attracted 100,000 followers.

The bustling development of AI micro-dramas in India is easily understood from a production perspective.

On one hand, Indian live-action micro-dramas have long suffered from "low budgets." Yang Liu, CEO of Easy Orange Light, revealed that the budget for producing a micro-drama in India is less than one-third of what is spent on an overseas micro-drama produced in China. "When I spoke with Indian producers before, they also complained that the budget was too low to manage."

On the other hand, AI micro-dramas are both low-cost and time-saving. Narain mentioned in a foreign media interview that producing a live-action micro-drama in India takes 1-2 months, while producing Raftaar only took three weeks.

Moreover, the entire series cost only 1 million Indian Rupees (about 80,000 RMB/ $11,000 USD). He contrasted this, stating: "Producing a micro-drama in India that includes similar car chase stunts would cost at least 8 million Rupees (about 650,000 RMB / $90,000 USD)."

Europe, US, Japan, South Korea: Unique Barriers and Long Paths to Breakthrough

The "cultural high-grounds" of Europe, the US, Japan, and South Korea present a different scene.

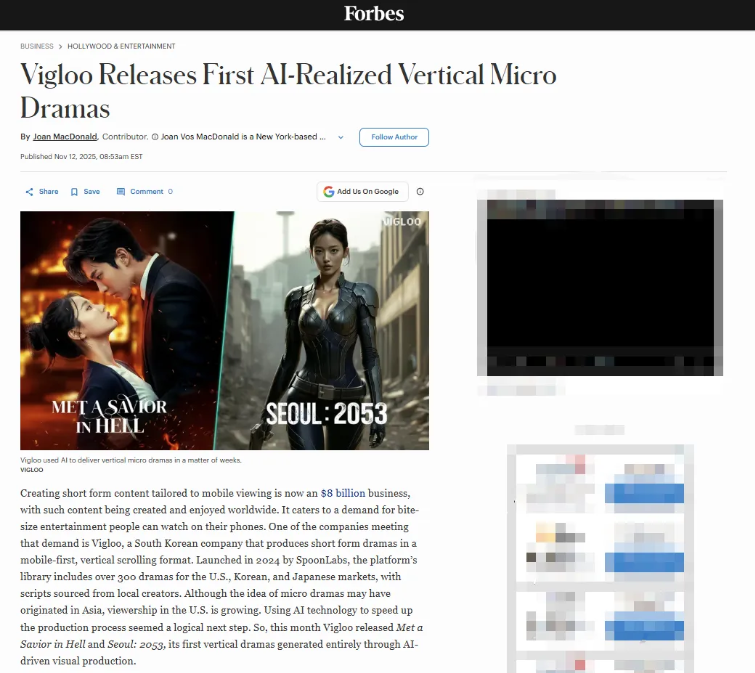

In October this year, Met a Savior in Hell and Seoul: 2053, marketed as "South Korea's first batch of AI-generated micro-dramas," premiered exclusively on Vigloo and were reported by Forbes.

Both dramas boast solid production quality. The former is an in-house produced romance by Vigloo, claiming to have been completed in just six weeks, with a 90% reduction in cost and a 50% shorter production cycle. The latter is a sci-fi drama in collaboration with South Korean production company ZANYBROS. [Screenshot from the Forbes official website]

[Screenshot from the Forbes official website]

Platform CEO Neil Choi is also highly optimistic about AI micro-dramas: "Our vision is rooted in collaboration between human creators and AI. Leveraging AI to enhance storytelling capabilities, expand audience reach, and redefine the infinite possibilities of entertainment."

However, the initial fanfare seems to have led to little substance. The two dramas have neither generated investment data nor been promoted on Vigloo's social media channels, and the platform does not display viewership numbers. Market feedback remains a mystery.

In Japan, a few local AI content platforms have appeared, but they are primarily small companies testing the waters, with no major platforms entering the fray.

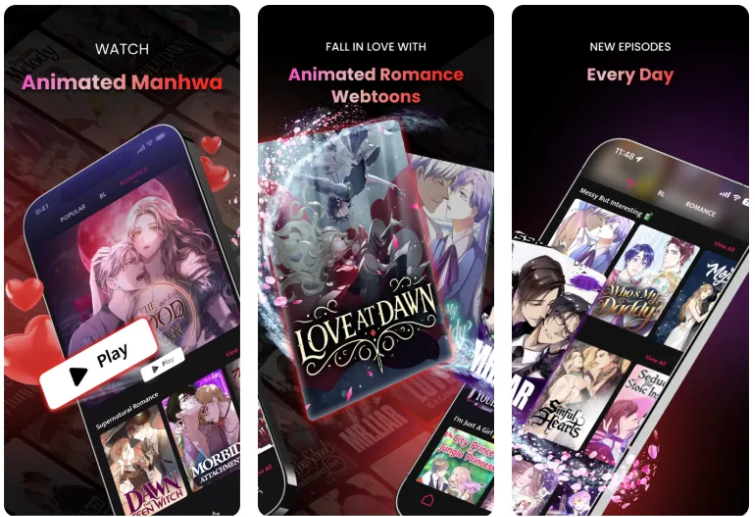

Take BlinkToon, which focuses on AI dynamic comics, as an example. Launched in March this year, it targets romance content, mainly in the genres of gender relations and BL (Boys' Love), covering urban, historical, and isekai themes. [Screenshot from BlinkToon product introduction page]

[Screenshot from BlinkToon product introduction page]

The App was developed by Taiyaki studio, a small startup in Tokyo. According to its official website, the company is committed to "redefining the animation viewing experience" and is hiring 2D animators with monthly salaries of 300,000-600,000 JPY (approximately $2,000 - $4,000 USD).

Notably, its cumulative downloads are about 50,000, with in-app purchase revenue just over $100. Furthermore, it has not yet covered the Japanese market, with downloads primarily coming from the US market. [Screenshot from Taiyaki studio official website]

[Screenshot from Taiyaki studio official website]

As a major exporter and domestic market for animation, the Japanese anime industry has long been plagued by low productivity. The reliance on manual drawing, while guaranteeing exquisite quality, results in long cycles and low output.

For this reason, some practitioners have publicly affirmed the value of AI as a tool; for instance, veteran cartoonist Yoshikazu Yasuhiko pointed out that AI can help improve efficiency and alleviate industry pressure.

However, in practice, the industry implicitly continues to follow traditional production methods. This suggests that the large-scale implementation of AI content, including AI animated comics, still faces considerable resistance in Japan.

Turning the focus to the US content market, the situation is even more complex.

The major strike over two years ago had the use of AI as one of its flashpoints, making the attitude of the mainstream US film and television industry towards AI tools self-evident.

Roger, the founder of North American micro-drama production company Sparkland, observed that film and television workers, unions, production companies, and film schools in North America all show a degree of rejection towards AI. "AI is hot in Silicon Valley, but relatively cold in Hollywood."

Essentially, Hollywood capital holds a complex mindset towards AI technology: they value AI's ability to significantly lower production costs but must also be vigilant about the dual challenges it presents.

Directly and publicly supporting AI is highly likely to trigger a strong backlash from guilds of writers and actors, destabilizing the industry. Furthermore, a deluge of AI-generated content could devalue the vast libraries of IP on which they rely for survival.

This inherent contradiction means the North American film and television industry is unable to embrace AI with the same conviction as their Chinese counterparts.

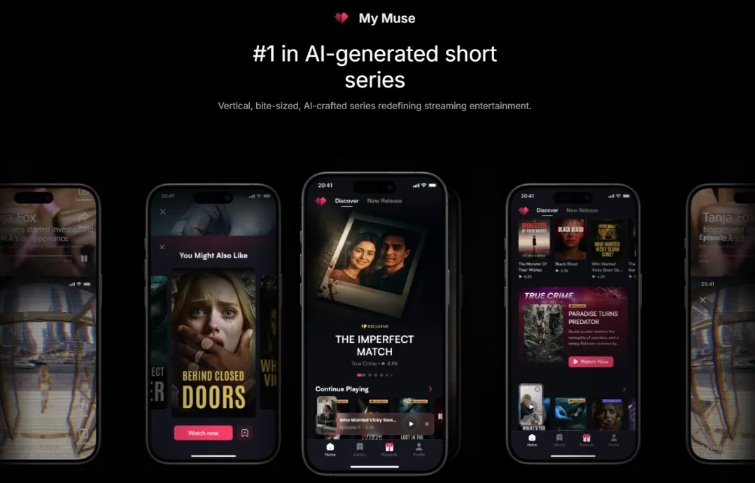

In contrast, the European company Holy Water, backed by Fox Entertainment, has embraced AI more freely. Not only has it incorporated AI interaction into My Drama, but it has also developed the application My Muse, which focuses on AI micro-drama content. [Screenshot from Holy Water official website]

[Screenshot from Holy Water official website]

Despite this, this AI tech startup has not placed AI micro-dramas at the forefront of its business.

A Holy Water executive once publicly stated that MyMuse is merely a tool for the company to test stories. If the market data is promising, they will re-shoot the drama with live actors and launch it on My Drama.

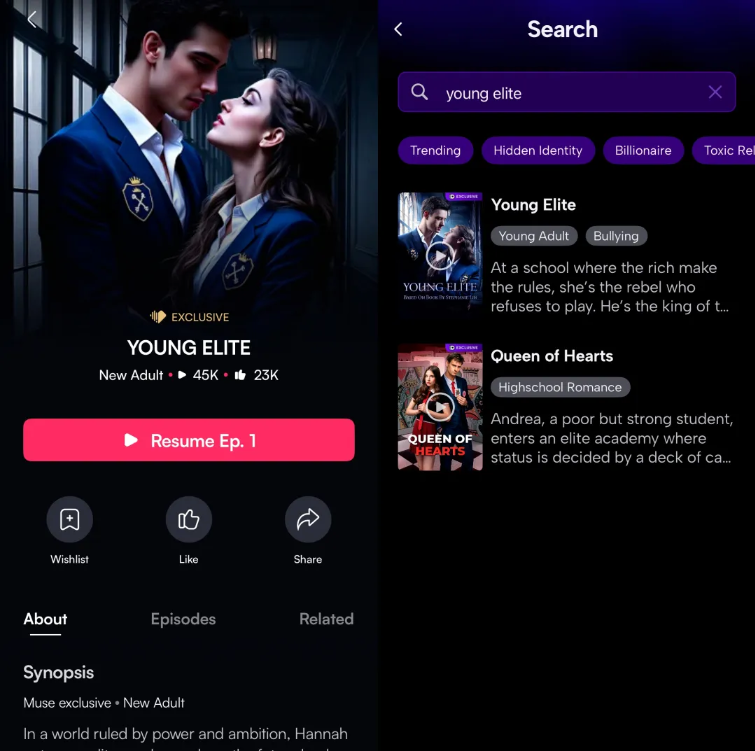

Take the campus micro-drama Young Elite as an example: the same theme and plot are mirrored on both Apps, with even the opening scenes being identical.

[Screenshot from MyMuse (left) and My Drama (right)]

[Screenshot from MyMuse (left) and My Drama (right)]

The reason is simple—AI micro-dramas are far less profitable than live-action ones. My Drama generated over $9 million in revenue and 1.3 million downloads in Q3 of this year. MyMuse's performance during the same period was dismal, with quarterly revenue of just $10 and only 73 downloads.

AI Micro-Dramas Go Global: Southeast Asia is the "Newbie Training Camp"

Turning our attention back to China, the AI micro-drama sector is entering its highlight era.

Driven by policy support, platform investment, and technological development, market expectations are high: Xiong Binghui, founder of Kemeng AI, predicts that by 2027, the penetration rate of AI micro-dramas (including animated comics) in the billion-level micro-drama market will climb to 30%-35%. Data from Ocean Engine further fuels this fervor, predicting the domestic animated comic market size will exceed 20 billion RMB within the year.

However, this "heat" from China seems not to have fully transferred to the overseas market.

Currently, there are no precise statistics for overseas Apps solely dedicated to AI micro-dramas globally.

The Micro-Drama Study (a market observer) screened existing overseas micro-drama Apps using the keyword "AI Drama" in the application details, yielding only 11 results. Apps containing "AI Anime/Cartoon/Comics" were less than 5. This number is insignificant compared to the large pool of over 200 overseas micro-drama Apps.

Despite this, a sample observation of these few Apps allows us to preliminarily outline some current strategies for AI micro-dramas going global.

1. Precise Probing with AI Live-Action Micro-Dramas.

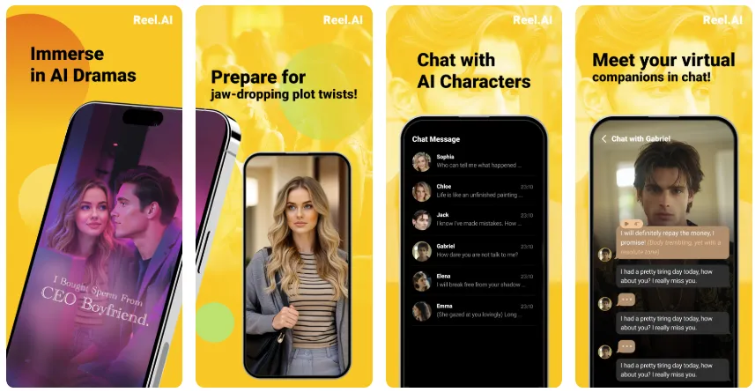

Represented by Reel.AI under Jingying Technology, the platform focuses on AI micro-dramas for female audiences. In addition to watching the dramas, viewers can also chat with AI characters outside the show. Its English micro-drama Five Brothers, entirely produced by AI, has appeared on several overseas charts. [Screenshot from Reel.AI product introduction page]

[Screenshot from Reel.AI product introduction page]

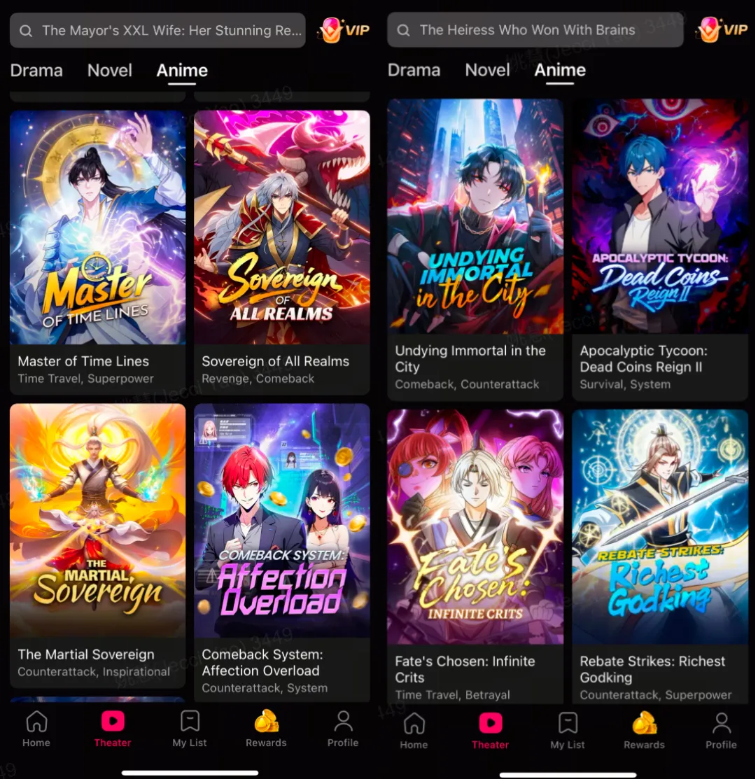

2. Sectional Expansion of Existing Overseas Micro-Drama Platforms.

Kunlun Tech's DramaWave has launched multiple AI animated comics featuring imaginative and fantasy themes, supporting 18 languages. Official data shows that the average viewing time for its animation content exceeds 30 minutes per person. China Literature (Zhongwen Online) stated that its FlareFlow has launched multiple AI animated comics, but its latest Q3 financial report did not disclose specific cases.

[Image from "Kunlun Tech Group" public account]

[Image from "Kunlun Tech Group" public account]

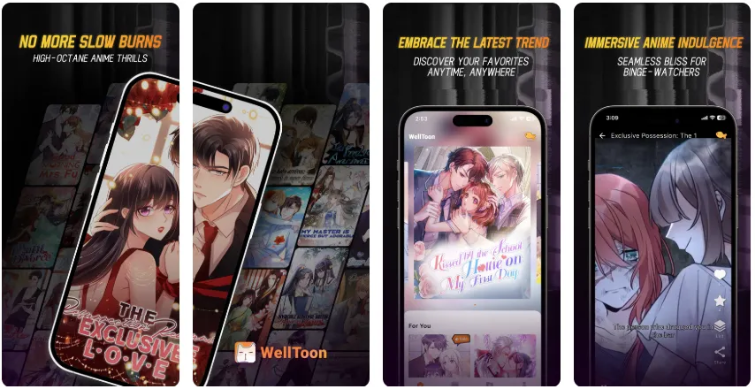

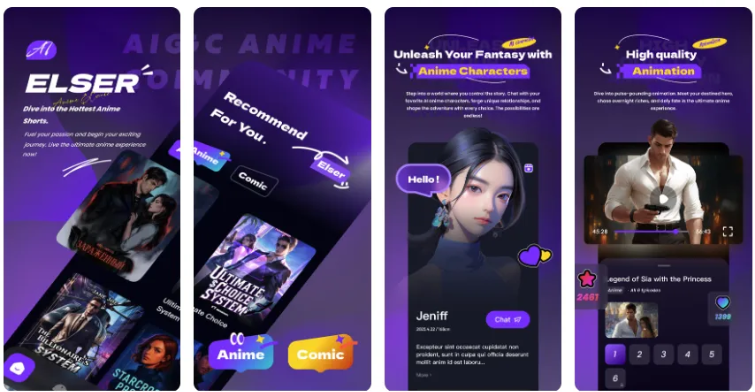

3. Vertical Deep Cultivation of AI Animated Comics.

Typical examples include WellToon by Shanghai Ako Culture Media, which focuses on flat, fresh-style female-oriented AI animation, covering niche themes like campus and urban romance. Elser.AI under Shanghai Xinying Dimension also focuses on AI animated comics, but the art style is 3D, and the themes lean more towards adult content.

[Screenshot from WellToon product introduction page]

[Screenshot from WellToon product introduction page]

[Screenshot from Elser.AI product introduction page]

[Screenshot from Elser.AI product introduction page]

4. Blending Complex Gameplay such as Interactive Plot and Emotional Companionship.

For example, PopShort.AI under Chuangyi Yingdong Technology integrates AI live-action micro-dramas, interactive plot selection, and character companionship features. Users can watch the micro-drama, choose the plot direction, and even chat with the protagonists outside the story for emotional companionship.

[Screenshot from PopShort.AI product introduction page]

[Screenshot from PopShort.AI product introduction page]

Although the entrants include both leading platforms and emerging startups, the industry as a whole is clearly still in a cautious exploratory phase. While major platforms are testing global markets, no large-scale investment is evident. Emerging platforms have yet to generate convincing data.

However, from a regional market perspective, the overseas expansion path for AI micro-dramas seems to be following the trajectory of earlier micro-dramas: entering through the Southeast Asian market to export technology and products.

This year, Nanjing Xuanjia Technology is working with relevant parties in Guangxi to jointly build the ASEAN AIGC Audio-Visual Content Production Export Base, dedicated to continuously exporting AI micro-dramas (including animated comics) to Southeast Asia. Hi View, jointly launched by China Guangxi Yaoxiang Culture and Cambodian BKL Media, officially launched in Phnom Penh, Cambodia, released its first Cambodian AI micro-drama, and will continue to export AI technology.

Last year, China Literature signed an AI dynamic comic distribution cooperation agreement with Singapore's largest media group, Mediacorp. 24 AI dynamic comic works were successively launched on Mediacorp's meWATCH platform, entering the Singaporean market.

Even so, the large-scale global expansion of AI micro-dramas is still in the "early stage."

Referencing the successful overseas path of micro-dramas, the premise was domestic overcapacity, followed by opening the market and acquiring incremental users through dubbed dramas, supplemented by localized dramas for deep cultivation. However, although AI micro-dramas are rapidly growing in China, the overall stock is still insufficient for the domestic market.

Therefore, for the vast majority of entrants, now is far from the time to divert energy to overseas expansion; focusing on the domestic market is the urgent priority.

Conclusion

Returning to the opening questions: How far has the overseas AI micro-drama reached?

Overall, the entire sector is still in the preliminary stage of "telling stories with AI." While the Indian cases have generated high interest, a sustainable business model has yet to be formed. Explorations in Europe, the US, Japan, and South Korea have been loud, but the lack of tangible results is evident. Meanwhile, Chinese players' attempts to go global are currently dominated by regional, small-step, fast-run strategies.

From a technological evolution perspective, the application of AI in the micro-drama sector is irreversible; it is destined to become a part of content production. However, a gap persistently exists between the "capability" of the technology and the "quality" of the content.

What will truly determine the future of AI micro-dramas is not how fast they run or how much money they save, but whether they can transcend the level of mere tool efficiency and enter the realm of narrative art—telling stories that are truly worth remembering.

After all, no matter how strong the computing power, it cannot replace empathy; and no matter how new the technology, it cannot replace the human desire for a good story.

![[Dubbed Version]Love Lost, Throne Forsaken](https://v.melolo.com/b1265344voduse1318177724/1ae337285145403705292848529/bge1fSRcSrYA.webp!15491.webp!15491.webp)